Have you ever typed a deeply personal question into Google? Questions like:

• When can I retire?

• Do I have enough saved?

• How much will I pay for healthcare?

• When should I start taking Social Security?

If so, you’re not alone.

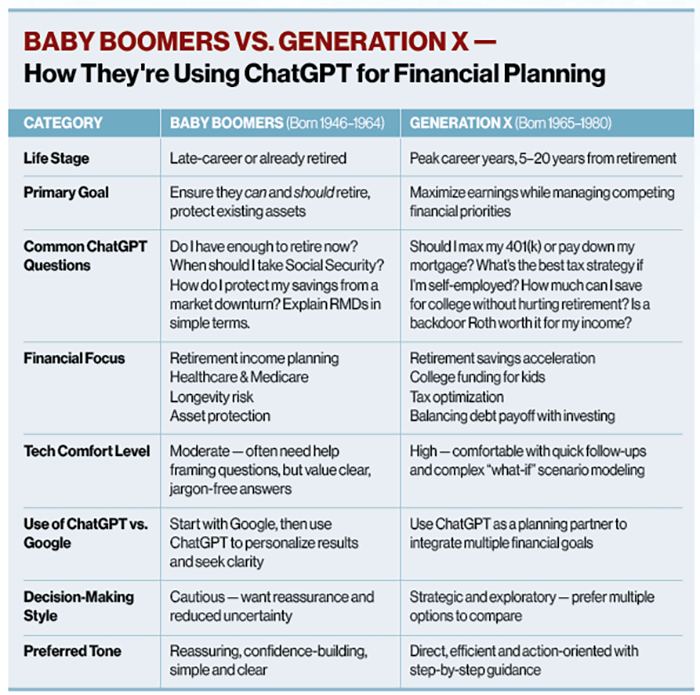

Baby Boomers (born 1946–1964, now ages 61 to 79) and Generation X (born 1965–1980, now ages 44 to 60) are increasingly using tools like Google and ChatGPT to explore these exact questions—and to understand how general financial advice applies to their specific lives. As these generations face pivotal financial decisions, their behaviors around online research and AI-powered tools like ChatGPT are evolving.

The Retirement Wave — and What Comes Next

The oldest Baby Boomers began turning 65 in 2011. By 2029, the youngest will reach that milestone, marking the end of the largest retirement wave in U.S. history. With nearly 10,000 people per day having entered retirement over the past decade, this group now largely depends on a mix of Social Security, 401(k)/IRA savings and personal investments.

Yet, this generation still faces critical risks:

▶ Longevity risk (outliving their money)

▶ Rising healthcare costs

▶ A desire to leave a legacy

Generation X is now entering the homestretch—15 to 20 years from retirement for many—and facing similar concerns. Their challenge is balancing today’s needs (mortgages, college tuition, aging parents) with future goals. The risks are real: even diligent savers may find themselves short if they don’t plan smartly.

So how do you avoid running out of money?

The advice is simple, but not always easy:

• Spend less than you earn—for a long time.

• Build a business (and maybe sell it).

• Hope for a windfall (inheritance or even a lottery ticket).

But there’s also a smarter option …

Meet with a Certified Financial Planner™ (CFP®)

Blending your self-guided research with professional advice can help turn information into action. Tools like ChatGPT are great at providing context, but they can’t replace a human who understands your full picture—and who can help you implement a strategy.