I don’t know about you, but I’ve had a pretty great summer! As of this writing, we have had rather reasonable weather; not too hot and not too cool – kind of a Goldilocks summer … just right. With the season in full swing, and the end around the corner as we head back to school, I think it’s time to re-visit the subject of budgeting. Many people often wonder, “how much of my income should I be spending on my mortgage? Or my cars? Or my food?” Although there is no hard line in the sand on these questions, there are guidelines to help us spend less than we earn.

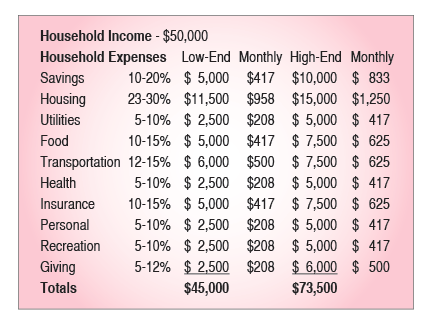

To help manage our expectations of a good starting point for a budget, I’ve compiled a list of major expenditures and some guideline percentages. According to the Department of Numbers.com, (deptofnumbers.com/income/Michigan), the average household income in Michigan is $51,084 as of 2015. So, we’re going to use an even $50,000 number as our baseline. I created the chart below to help us examine a rough breakdown of what a budget could look like.

From this chart, there are some obvious facts we can glean. You can see that if we come in at the high end of the range on every expense, we end up over-spending by almost 50% more than what we make. Again, these are benchmarks to provide a starting point for what we should be spending. Every household is going to be different and place a different value on specific areas. Some may give more and spend less on recreation or vice versa. To be in a good financial position, families can examine these percentages and make comparisons with their own household income to make sure that each month, they are spending less than they make.

The families I have encountered that budget most effectively will have a weekly budget review and conversation to ensure they are staying within their guidelines. I know it seems daunting at times; but this is a must-do for people on the path to financial prosperity. It doesn’t matter if you make $40,000 or $400,000 – to budget successfully, we all need to spend less than we bring in.